1. The Divide No One Talks About

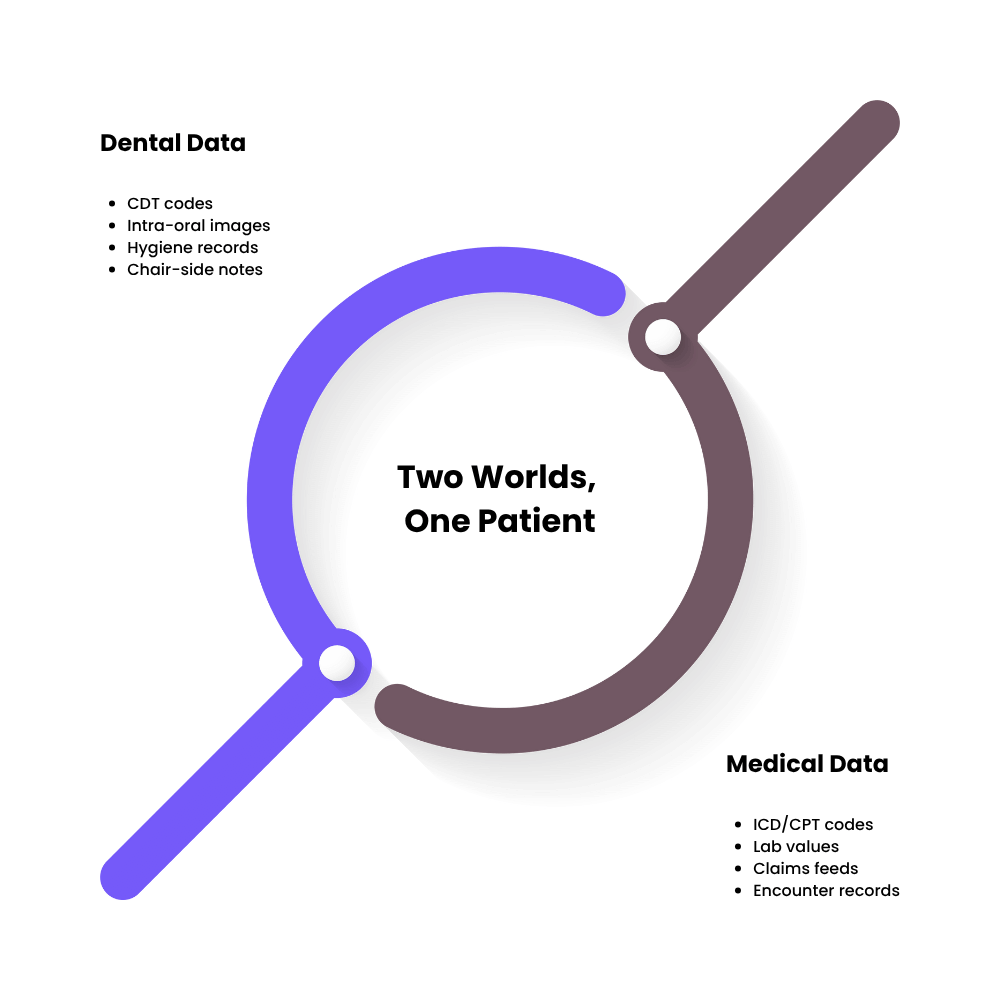

Two worlds, one patient

For years, dental tech innovators have built sophisticated tools for imaging, scheduling, and chair-side automation. Yet these systems still exist in isolation from broader healthcare infrastructure.

- Dental data relies on CDT codes, intra-oral images, hygiene records, and patient notes.

- Medical systems speak a different language, viz. ICD/CPT codes, lab values, claims feeds.

The result: two digital ecosystems documenting the same patient but telling entirely different stories.

According to DocMode, integrating dental and medical records leads to measurable gains in outcomes and cost efficiency, yet adoption remains low across most markets.

Why this matters

From a payer’s perspective, oral health has long been treated as a peripheral service; important, but not integral to chronic-care management.

Meanwhile, dental tech founders find themselves trapped in a paradox: they’re solving real problems, but only within a “dental silo.” As value-based care accelerates, that isolation is no longer sustainable.

The shift toward whole-person care means reimbursement, risk contracts, and quality reporting all depend on unified data. Founders who remain disconnected risk being invisible in payer analytics and integrated-care initiatives.

The hidden challenge

The biggest hurdle isn’t a missing API- it’s a missing common language between oral and systemic health.

Until dental platforms are engineered to communicate with medical claims, risk-stratification engines, and population-health dashboards, the full value of oral data will stay locked away.

For dental tech innovators, the challenge ahead is not just building software, it’s reframing the conversation from dental technology to healthcare technology.

As the American Dental Association and CMS continue exploring oral-medical integration pilots, early movers who align data and terminology will be best positioned for payer trust and long-term growth (ADA News, CMS Innovation Center).

2. Why Integration Matters Now

Oral health’s ripple effects across care

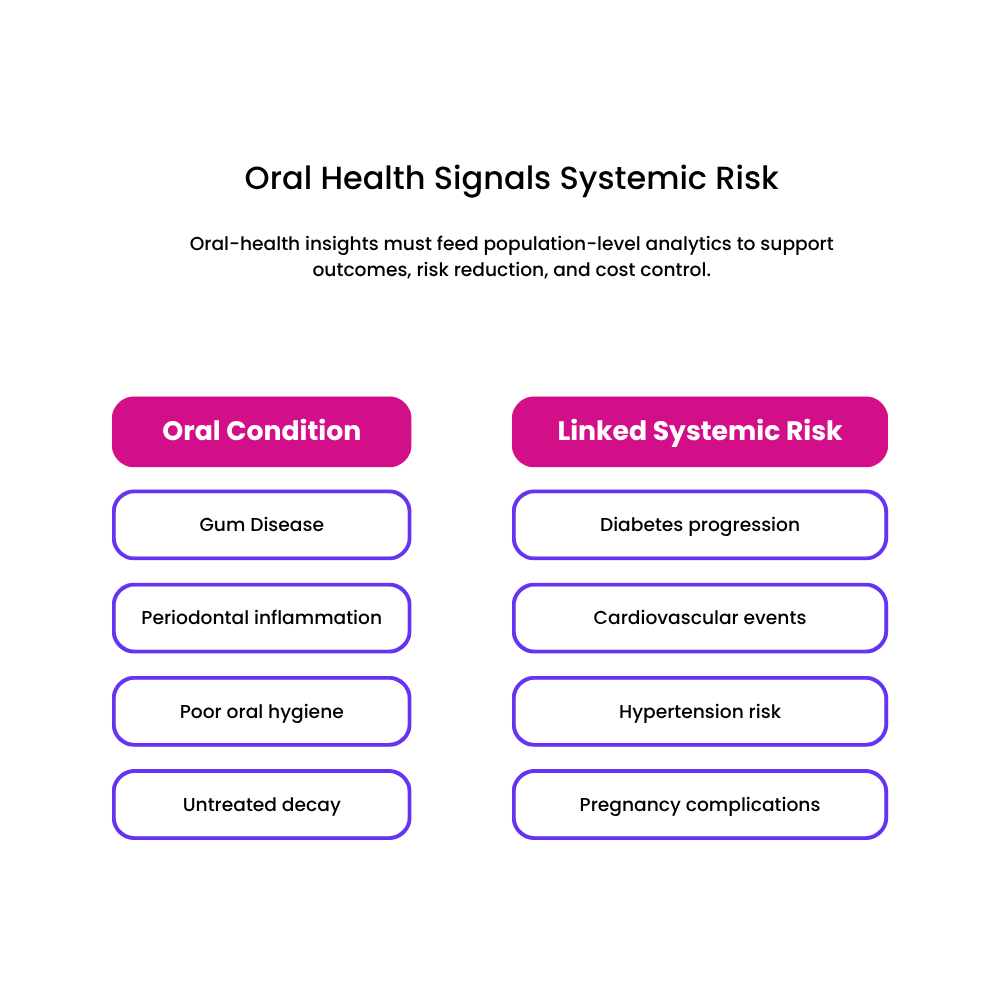

It’s no longer enough for dental clinics to treat cavities and gum disease as isolated issues. Emerging evidence shows that poor oral health is deeply entwined with chronic systemic conditions. For example, people with uncontrolled gum disease often face higher risks of diabetes, cardiovascular disease, hypertension and adverse pregnancy outcomes.

From a value-based care perspective, this means that oral-health interventions can no longer be siloed; they must contribute to the broader goals of reducing total cost of care, improving outcomes, and managing population risk.

Payers and population health are shifting the goal-posts

Health-care payers, Medicaid agencies and accountable-care organisations are demanding more than procedural volume; they want measurable outcomes and cost offsets. Within that shift, oral health is gaining traction as a meaningful lever. One white paper points out that integrating dental and medical claims data gives employers and payers a fuller view of member risk, enabling smarter stratification and intervention.

In short: dental-tech innovators who still focus only on chair-side efficiency or practice workflows risk missing the boat. The new frontier is population-level analytics, where a dental data set becomes a vital contributor to a unified patient story.

Immediate opportunities for dental tech founders

- Care-gap identification: With connected dental + medical data you can surface patients who have untreated oral-health issues and unmanaged chronic conditions. That dual insight becomes highly relevant for payers and risk-bearing providers.

- Risk-stratification contribution: By funneling oral-health metrics (e.g., periodontal scoring, untreated decay, hygiene frequency) into wider risk-models, dental platforms can help shift the narrative from “dental cost centre” to “health-cost driver”.

- Longitudinal tracking: Gone are the days when a dental visit ends at exiting the chair. Founders must think in terms of patient journeys over years: tracking how oral-health improvements lead to downstream impacts (fewer ER visits, fewer complications) and proving that to stakeholders.

Why founders can’t wait

The window for entering integrated-care contracts is closing. Payers and health-systems are increasingly awarding large-scale deals only to vendors who can demonstrate interoperable, data-rich solutions that speak across domains (dental + medical). If your product remains divorced from medical-claims feeds, SDoH data, and risk scoring frameworks, you risk being excluded from the next generation of reimbursement models.

The takeaway

For dental-tech founders, the message is clear: the act of building a great dental-practice tool is no longer sufficient. You must build a product that connects,one that links oral health to systemic outcomes, integrates into payer and provider workflows, and supports analytics at a population level. Those who act now will position themselves for the value-based future of healthcare; those who don’t will find their innovations sidelined.

3. Where the Data Gap Lies

Two systems, two dialects

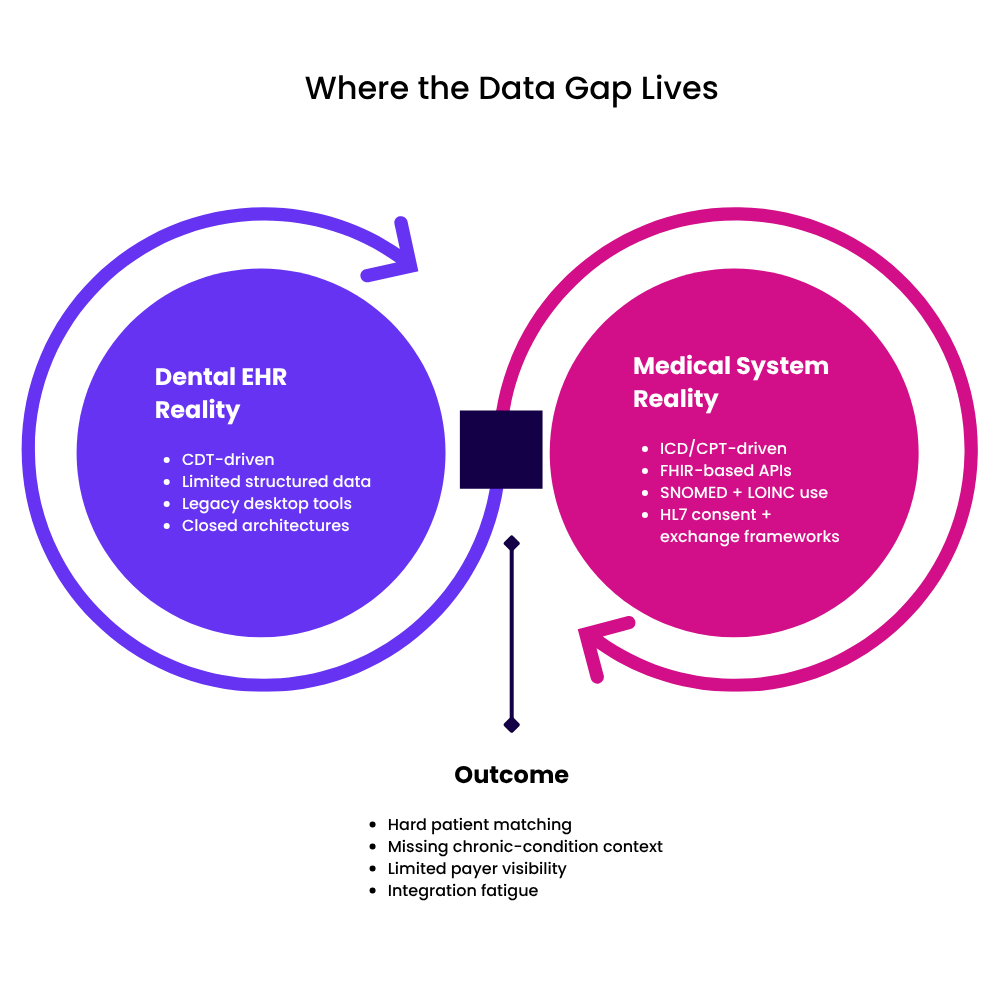

Dental and medical data don’t just live in separate systems- they speak entirely different dialects.

- Dental data revolves around CDT codes, clinical notes, radiographs, and practice-management workflows.

- Medical data runs on ICD and CPT codes, claims hierarchies, and lab or encounter data standardized for population-health analytics.

Because the two were never designed to talk to each other, even basic patient matching or care-gap tracking becomes an uphill climb. Studies have shown that inconsistent coding and incompatible record structures remain the biggest barrier to oral-medical data integration (PubMed Central).

The silo effect in action

Most dental EHRs were built for billing efficiency and chair-side charting, not for longitudinal analytics.

- They store limited structured data, often lacking fields for medical comorbidities or SDoH insights.

- Their architectures are frequently closed or proprietary, making data export and normalization difficult.

- In many cases, practices use legacy desktop applications with minimal interoperability support.

Meanwhile, medical systems, designed under HIPAA, HL7 v2, and FHIR paradigms, expect well-defined APIs, consent frameworks, and terminologies. When these two ecosystems meet, translation gaps emerge everywhere: identifiers, timestamps, and even clinical context differ.

The consequences for innovation

Because of this divide, dental startups face three persistent roadblocks:

- Incomplete patient context – Without access to lab results or chronic-condition data, dental analytics can’t accurately identify high-risk patients.

- Limited payer visibility – Payers can’t quantify oral-health ROI when data can’t be tied back to claims or quality-measure logic.

- Integration fatigue – Developers spend more time building one-off data bridges than improving actual care workflows.

A recent ONC brief notes that only a fraction of dental software vendors currently support interoperable exchange using the US Core FHIR profiles (ONC Interoperability Report 2024). The result: valuable dental insights remain locked away from broader population-health initiatives.

The bigger picture

This isn’t just a technical gap- it’s a semantic and strategic one. Dental tech founders must reimagine how oral-health data fits into the continuum of care. Until a shared language exists between CDT and ICD worlds, and until data can flow seamlessly between clinical, payer, and analytics systems, dental tech will continue to operate on the sidelines of value-based care.

4. The Technical and Structural Barriers

Why technology alone can’t fix this

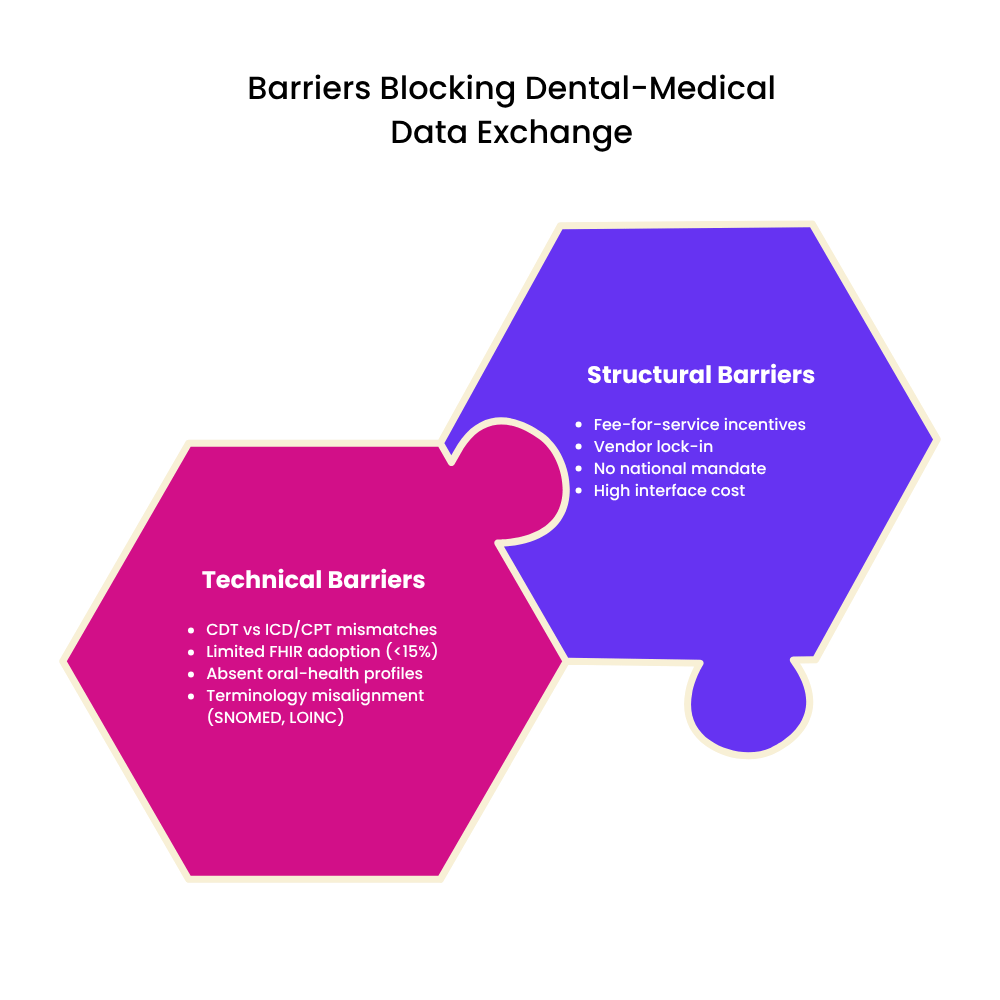

Bridging dental and medical data isn’t just a software challenge; it’s an architectural one. Most dental EHRs were designed decades ago for billing efficiency, not interoperability. Their data structures are often proprietary, lacking the semantic mapping or APIs required for exchange with medical systems. According to the ONC’s 2024 Interoperability Standards Report, fewer than 15 % of dental vendors have implemented any version of FHIR for external exchange.

Fragmented standards and limited mappings

- CDT vs ICD/CPT: Dental codes are procedure-focused, while medical codes capture diagnoses and care contexts. This one-to-many mismatch makes automatic mapping error-prone.

- FHIR immaturity: Although HL7 FHIR is now the backbone of health-data exchange, dental-specific profiles are still emerging; no universal implementation guide exists for oral health.

- Terminology silos: SNOMED CT and LOINC are widely used in medicine but rarely embedded in dental workflows, creating semantic blind spots.

A recent review in the National Library of Medicine notes that terminology non-alignment remains a leading cause of interoperability failure between oral and systemic care platforms.

Structural and economic inertia

Even when APIs exist, systemic incentives discourage integration:

- Fee-for-service legacy: Dental reimbursement still rewards procedures, not outcomes- reducing the financial drive to share data.

- Vendor lock-in: Many dental EHRs use closed architectures to retain customers, making external interfaces expensive or proprietary.

- Fragmented governance: Unlike medical health IT, there’s no national interoperability mandate or certification body enforcing open exchange in dental software.

This combination of outdated incentives and misaligned priorities explains why, despite technical feasibility, data exchange adoption remains slow.

Pathways emerging

There are glimmers of progress. Pilot programs under CMS Innovation Center and several state Medicaid agencies are exploring integrated oral-medical quality measures. Major EHR vendors such as Epic and Dentrix Ascend are testing FHIR-based connectors for shared patient IDs and risk indicators. Industry groups including the ADA Standards Committee on Dental Informatics (SCDI) are drafting mapping frameworks that could close the gap by 2026. (ada.org)

The bottom line

Dental-tech founders need to see these barriers not as roadblocks, but as strategic entry points. Those who invest early in open APIs, FHIR alignment, and terminology normalization will be better positioned to partner with payers and health systems when integration becomes a compliance expectation rather than a choice.

5. Signs of Change: Early Integrators and Frameworks of Hope

Momentum is building

While the barriers between dental and medical data remain formidable, several initiatives and pilot programmes are showing that integration is not just possible; it’s happening.

- For example, the state-based pilot described by CareQuest Institute for Oral Health reports that Federally Qualified Health Centres (FQHCs) which attempted medical-dental integration improved care coordination and began realising the value of shared data.

- One pilot across six state health departments showed how collaboration between oral-health and chronic-disease programmes led to measurable improvements in service linkage.

These examples matter because they shift the narrative: from “dental is always separate” to “dental can be an integral part of whole-person care.”

Real-world integration models to watch

Here are concrete models giving dental-tech founders a blueprint:

- Health Plan of San Mateo (HPSM) in California launched a dental plan for Medi-Cal members that includes medical, dental and behavioural-health benefits, streamlining care and claims across domains. HPSM

- The Texas Department of State Health Services (DSHS) “Preventive Oral Health Care Integration” initiative emphasises collaboration between medical-providers and dental-providers, particularly in prenatal care where oral-health risks map strongly to systemic outcomes. Texas Health Services

These models show that the shift is not just technical- it’s organisational, financial, and strategic.

Emerging frameworks and standards

To support this change, industry frameworks are being developed:

- The Health Resources and Services Administration (HRSA) created the Integration of Oral Health and Primary Care Practice initiative which lays out core competencies for primary-care clinicians to engage in oral-health screening, collaboration, and referral workflows. HRSA

- The “Medical-Dental Integration” white-paper from Delta Dental Institute emphasises that EHR/EDR interoperability is the linchpin of successful integration models. Delta Dental Institute

For dental-tech founders, these frameworks signal what significant stakeholders consider critical; areas to align with if you want to play in the integrated-care sandbox.

What the “after” state could look like

Picture the future:

- A patient visits their dentist and the dental EHR automatically flags a rising HbA1c metric pulled in from the patient’s medical claims; a coordinated care-gap alert triggers a referral to the primary-care provider.

- A health plan has a unified dashboard that merges dental procedure data with medical encounter data, enabling risk stratification that includes periodontal disease as a predictor of cardiovascular events.

- Trends across populations show dental-care utilisation linked to fewer expensive ER visits and fewer hospitalisations for diabetes complications.

That’s the promised land- where dental tech is not an add-on, but an integral node in population-health analytics, reimbursement strategies and value-based care models.

What this means for dental founders

For founders in the dental-tech space, the takeaway is clear:

- Track and align with these real-world models (like HPSM, Texas DSHS); they are the early harbours of integration.

- Use the frameworks (HRSA, Delta Dental Institute) to benchmark your product’s readiness for interoperability, referral workflows and data exchange.

- Respond to the “after” state- define how your solution contributes to unified patient data flows, strategic insight for payers and longitudinal tracking of oral and systemic health.

In short: the sea is changing. The value-based care currents are shifting. Those who adapt now by embracing the integration narrative will be well-positioned. Those who don’t risk being left behind.

6. What Founders Can Do Differently

Reframe interoperability as a growth strategy

For dental-tech founders, integration isn’t just a compliance checkbox, it’s a business differentiator. Payers and health systems increasingly select vendors based on how easily their data fits into longitudinal-care and quality-reporting frameworks. It can be safely assumed that companies positioned as data collaborators rather than data owners see faster payer adoption and higher contract renewals.

Think of interoperability as part of your GTM narrative: the ability to feed actionable oral-health insights into medical workflows is a story that buyers want to hear.

Build “translation layers,” not just features

Your next product sprint shouldn’t only deliver new modules; it should deliver semantic bridges.

- Map CDT codes to ICD where possible, leveraging SNOMED CT or custom terminologies.

- Incorporate FHIR R4/R5 resources such as Condition, Procedure, Observation, and CarePlan to align with payer and provider data models.

- Use middleware or data-exchange APIs that normalize dental data into structures recognizable by population-health platforms.

FHIR toolkits from HL7 and the ADA’s Dental Data Exchange Project are practical starting points (hl7.org, ada.org).

Speak the payer’s language

To earn payer trust, show measurable impact, not just clinical capability.

- Report outcomes that link oral care to reduced medical spend (e.g., fewer diabetic emergencies, lower cardiovascular risk).

- Align your reporting templates with HEDIS, eCQM, or state-specific quality measures.

- Build dashboards that mirror payer logic, viz. risk cohorts, care-gap closure rates, total cost of care.

When payers see dental data supporting their core KPIs, collaboration follows naturally.

Partner early, not late

Don’t wait for integration mandates to arrive.

- Engage DSOs, payers, and Medicaid programs early to co-design pilot exchanges.

- Collaborate with health-system IT teams to understand their interoperability pain points.

- Participate in oral-medical integration working groups under the ADA, HL7, or local public-health departments.

These partnerships help shape standards while positioning your brand as an early influencer, not a late adopter.

Build a culture of whole-person thinking

Integration starts with mindset. Train your product, marketing, and clinical-ops teams to think beyond the dental chair; to see oral health as a driver of systemic wellbeing. Encourage them to read up on social determinants, chronic-care pathways, and payer risk adjustment models. That internal cultural shift turns interoperability from an engineering task into an organisational mission.

The actionable summary

| Priority | Founder Action | Outcome |

|---|---|---|

| Strategic | Position interoperability as ROI driver | Payer & DSO traction |

| Technical | Adopt FHIR R5, SNOMED CT, mapping pipelines | Easier data exchange |

| Financial | Link oral data to medical cost offsets | Reimbursement inclusion |

| Cultural | Promote whole-person awareness in teams | Stronger brand credibility |

7. Conclusion: Building More Than a Product, Building a Bridge

The shift from software to stewardship

Dental technology is entering a defining moment. For years, innovation has focused on making practices more efficient; the next decade will be about making healthcare more connected. The future winners won’t be those with the best clinical UI, but those whose platforms speak the same language as payers, physicians, and population-health systems. Integration isn’t just a feature; it’s stewardship- the responsibility to make oral data count in the broader narrative of patient wellbeing.

The vision forward

Imagine a healthcare ecosystem where every oral-health touchpoint feeds into a single, longitudinal patient view, where a dental visit informs diabetic-risk analytics, prenatal care plans, or chronic-disease management dashboards. This is the world value-based care is heading toward, and dental innovators can be among its architects. As the ADA and CMS integration pilots expand and FHIR continues to evolve, the “bridge” between dental and medical will become the new standard, not the exception. (ada.org, cms.gov)

The founder’s calling

For dental-tech founders, the challenge is clear yet empowering:

- Lead with data empathy. Understand how your product fits into care coordination, not just billing.

- Build with openness. Every new connector, API, or standardized data model widens the bridge.

- Think longitudinally. A patient’s health story doesn’t end at the mouth, and neither should your data.

This is bigger than interoperability compliance. It’s about designing the connective tissue that helps healthcare systems see people whole.

Final takeaway

The dental-medical divide is no longer an inevitability; it’s an opportunity. Founders who step up now, architecting products that translate, connect, and inform, will not only gain market advantage but redefine the very place of oral health in the value-based era.

In short: you’re not just building dental software.

You’re building the bridge that makes whole-person care possible.