- Solutions

-

-

-

Data lifecycle management for seamless source-to-destination data movement, next-gen analytics and AI integration.

Advanced Data ETL, Reporting and Gen AI

No-code data engineering

Automated data transformation

Enterprise-grade LLM

MODULES

An automated data orchestration and pipeline management platform.

An AI-powered, enterprise-ready Gen AI platform for internal teams.

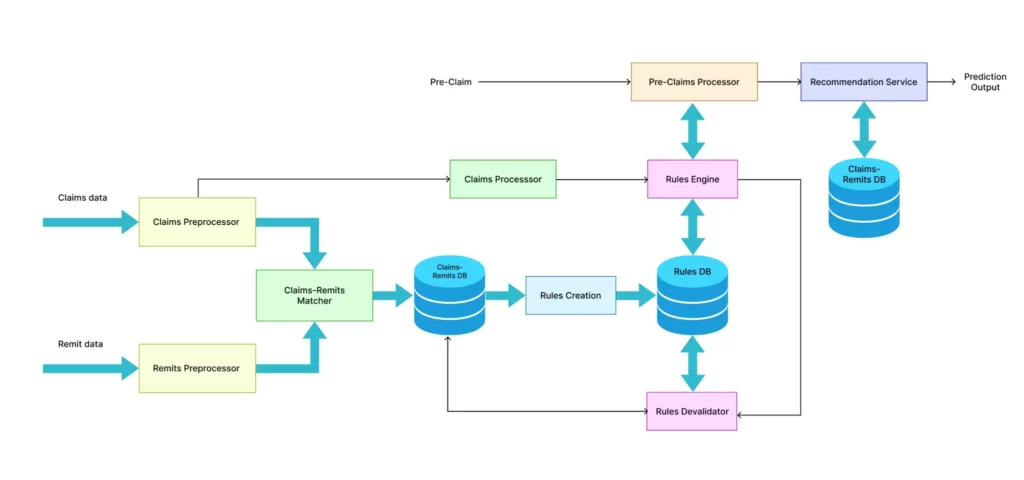

Healthcare Data Management

Parsing engine and interactive mapper.

Precision parsing, mapping, transformation & health data analytics.

-

-

-

- Capabilities

-

-

-

Data lifecycle management for seamless source-to-destination data movement, next-gen analytics and AI integration.

Advanced Data ETL, Reporting and Gen AI

No-code data engineering

Automated data transformation

Enterprise-grade LLM

Custom, integrated predictive layer.

Automated data movement for faster time-to-insights.

Consolidated data for improved accessibility.

Structured data for reporting, analytics and model training.

Solutions that ensure

-

-

-

- Resources

-

-

-

Data lifecycle management for seamless source-to-destination data movement, next-gen analytics and AI integration.

Advanced Data ETL, Reporting and Gen AI

No-code data engineering

Automated data transformation

Enterprise-grade LLM

Explore how businesses leveraged our data solutions to their advantage.

Keep up with the latest trends to scale faster and outwit competition.

Explore more

-

-

-

- About

-

-

-

Data lifecycle management for seamless source-to-destination data movement, next-gen analytics and AI integration.

Advanced Data ETL, Reporting and Gen AI

No-code data engineering

Automated data transformation

Enterprise-grade LLM

We are a bold team supporting bold leaders like you ready to adopt and migrate to new technologies.

Discover the essence of our tech beliefs and explore the possibilities they offer your business.

Unlock your business potential by leveraging Gen AI and capitalizing on rich datasets.

Lead your business to new heights and scale effortlessly with expert guidance along the entire customer journey.

-

-

-

- Join the team